This comprehensive guide analyzes the Bitlayer (BTR) token sale opportunity, providing detailed insights into the project’s fundamentals, investment mechanics, risks, and potential returns to help you make an informed investment decision. We will provide a complete analysis on Bitlayer, providing why its a good investment, Bitlayer red flags, BTR token TGE supply, expected profits and returns from BTR token sale and step by step guide on how to buy BTR tokens.

Bitlayer token sale is completed on Coinlist and is BTR token sale available on Binance August 13, 2025.

What is Bitlayer token?

Bitlayer is a new Bitcoin Layer 2 project aiming to bring smart contract features and more usability to Bitcoin, hoping to capture part of the decentralized finance (DeFi) market. The excitement around Bitlayer includes its use of “BitVM,” an early-stage technology that promises better security and scalability for Bitcoin applications. If you’re considering investing in Bitlayer’s token sale, here’s a simple breakdown to help you make an informed decision.

- Trust-minimized BitVM Bridge: Enables secure, verifiable Bitcoin transfers without relying on centralized custodians

- Bitcoin Rollup Architecture: Verifies all state transitions directly on Bitcoin for hard finality

- High-performance Execution Engine: EVM-compatible engine with sub-10ms latency for fast smart contract execution

How Many BTR Tokens Hit the Market at TGE Launch?

- Total Supply: 1 billion BTR tokens.

- Immediate Circulating Supply at Launch: About 103 million BTR (10.3%).

- Where do Bitlayer tokens come from at TGE?

- CoinList Public Sale: 33.3 million BTR, unlocked and circulating at TGE (Token Generation Event).

- Binance Pre-TGE Program: 20 million BTR, locked until shortly after TGE.

- Binance Booster Airdrop: 30 million BTR, but with a typical vesting period (~30 days or more post-drop). Read how to get Bitlayer airdrop with step by step details

- DApp Leaderboard & Other Airdrops: About 27 million BTR released through competitions and incentives.

Bottom line: Roughly 10% of all BTR tokens will be able to circulate during TGE and the immediate weeks after, with the rest locked or vesting.

Bitlayer Token Sale Details on Coinlist

| Parameter | Option 1 | Option 2 |

|---|---|---|

| Target Investors | Non-US only | US accredited investors only |

| Sale Price | $0.20 per BTR | $0.15 per BTR |

| FDV | $200 million | $150 million |

| Minimum Investment | $100 USD | $5,000 USD |

| Maximum Investment | $2,000,000 USD | $2,000,000 USD |

| Vesting Schedule | 100% unlock at TGE | 100% unlock after 1 year |

| Tokens Available | 20,000,000 BTR (2.0%) | 13,333,333 BTR (1.33%) |

Why Bitlayer token is a good investment?

Bitlayer has demonstrated significant traction since its mainnet launch in April 2024:

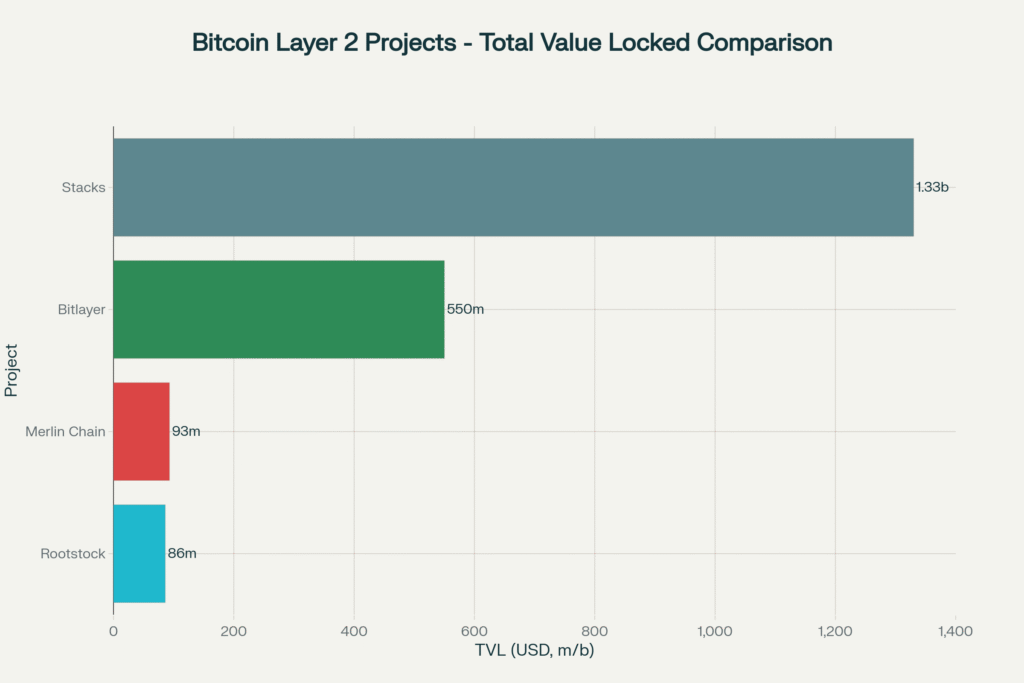

- High TVL: Over $550 million in total value locked, ranking among top Bitcoin L2 solutions

- Ecosystem Growth: 300+ projects deployed across DeFi, Gaming, NFTs, and infrastructure

- User Adoption: 700,000+ community members actively using the platform

- Transaction Volume: Processing 150,000+ transactions daily with median gas fees of $0.1

- Institutional Backing: Secured $25 million in funding from tier-1 investors

Bitlayer (BTR) Token Allocation & Vesting

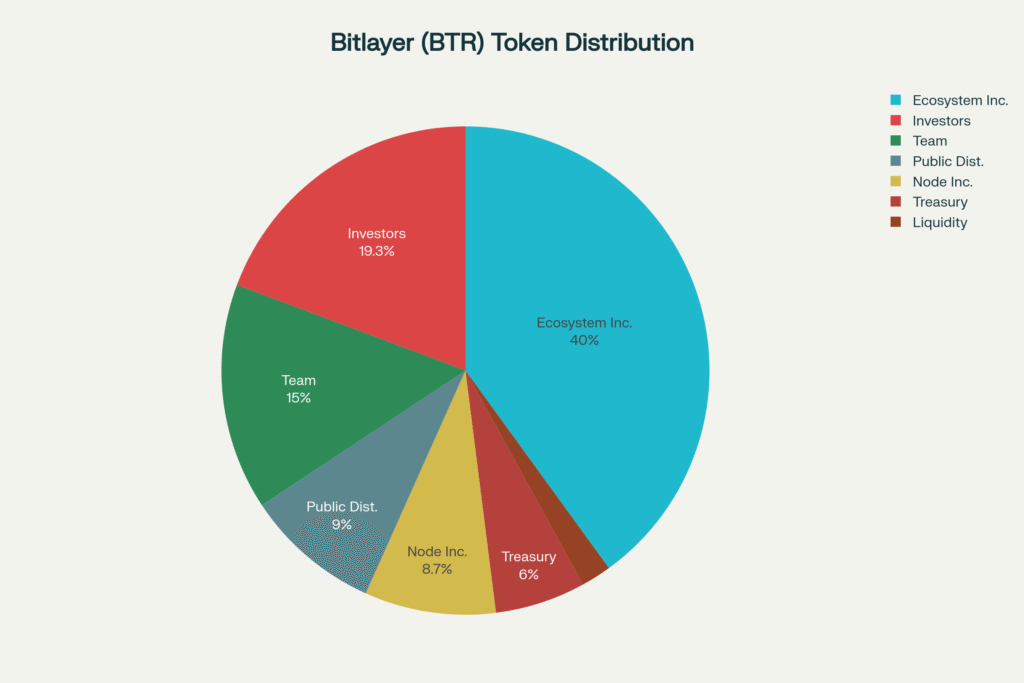

Total Supply: 1,000,000,000 BTR

Below is the full token distribution—covering all public sales, pre-TGE events, airdrops, ecosystem incentives, and team/investor allocations—along with vesting and unlock schedules.

| Category | % of Supply | Tokens (BTR) | Unlock/Vesting Schedule |

|---|---|---|---|

| 1. Public Distribution | 3.33% | 33,333,333 | |

| – Non-US Public Sale (Option 1) | 2.00% | 20,000,000 | 100% unlocked at TGE (Aug 7, 2025) |

| – US Accredited Public Sale (Option 2) | 1.33% | 13,333,333 | 100% unlocked 12 months post-TGE |

| 2. Pre-TGE & Booster Programs | 5.00% | 50,000,000 | |

| – Binance Wallet Pre-TGE | 2.00% | 20,000,000 | Locked until official circulation |

| – Booster Airdrop Program | 3.00% | 30,000,000 | Phase 1: Instant 8-h unlock for 5.7 M Phase 2: 60-day vest for 7.5 M Phase 3: Phase-based vest for 16.8 M |

| 3. Ecosystem Incentives & Airdrops | 40.00% | 400,000,000 | Rolling distributions over 36 months via: – Developer grants – DApp leaderboard rewards – Community quests & future airdrops |

| 4. Investors & Partners | 19.30% | 193,000,000 | 12–24 month vesting with 6-month cliff |

| 5. Team & Founders | 15.00% | 150,000,000 | 12-month cliff + 36-month linear vest |

| 6. Node Incentive (Validators) | 8.70% | 87,000,000 | Distributed to active validators over 24 months |

| 7. Treasury & Future Reserves | 6.00% | 60,000,000 | Locked for 24 months, then governed by DAO |

| 8. Liquidity Provision | 2.00% | 20,000,000 | 25% unlocked at TGE, 75% over 12 months |

| 9. Miscellaneous (Launch Contributors, advisors) | 5.67% | 56,666,667 | Various cliffs (6–12 months) and linear vesting |

Step by step guide to invest in Bitlayer token sale

Participation in the Bitlayer token sale requires:

- Registration: Complete KYC verification on CoinList platform

- Funding: Deposit minimum investment amount in USDT or USDC. Use this guide to buy USDT/USDC and transfer it to Coinlist to buy BTR token

- Accreditation: US investors must prove accredited investor status

- Purchase Window: Submit purchase requests during the 7-day sale period

- Allocation: Tokens distributed using “Filling from the Bottom” methodology

How much BTR token on TGE?

At TGE (estimated August 2025), the immediately available BTR supply will consist of all fully unlocked public‐sale tokens, the unlocked portion of the liquidity pool, and the Phase 1 Booster airdrop. Specifically:

- Public Non-US Sale (Option 1): 20 million BTR (100% unlocked)

- Liquidity Provision Pool: 20 million BTR total, of which 25% → 5 million BTR unlocked at TGE

- Booster Program Phase 1: 5.7 million BTR unlocked ~8 hours post-TGE

Total TGE Supply = 20 M + 5 M + 5.7 M = 30.7 million BTR available for trading immediately upon launch.

TGE Price Scenarios and Expected Returns

Based on comparable Bitcoin Layer 2 launches and project fundamentals, several price scenarios emerge for the Token Generation Event:

| Scenario | TGE Price | Option 1 ROI | Option 2 ROI | Market Cap | Rationale |

|---|---|---|---|---|---|

| Conservative | $0.25 | 25% | 67% | $250M | Similar to other L2 launches |

| Moderate | $0.35 | 75% | 133% | $350M | Strong fundamentals justify premium |

| Optimistic | $0.50 | 150% | 233% | $500M | First-mover advantage in BitVM space |

| Bear Case | $0.15 | -25% | 0% | $150M | Market downturn or technical issues |

Technical and Market Risk of buying Bitlayer

- New & Untested Technology: Bitlayer’s BitVM architecture is promising but unproven at scale. The two-party limitation restricts some uses, and high technical stakes mean bigger risks.

- Security Concerns: Cross-chain bridges, like the ones Bitlayer must use to connect to Bitcoin, are top targets for hacking in crypto. Billions have been lost to such exploits.

- Competition: Bitlayer faces big players like Stacks, Rootstock, and Lightning. In 2024, top Layer 2 tokens and networks saw their prices drop by 40–70%.

- Liquidity Problems: Only a small percentage of tokens are unlocked. No strong guarantee of a healthy, liquid secondary market to support new demand.

Risk-Based Investment Allocation/ How much to invest in Bitlayer

| Risk Profile | Recommended Amount | Portfolio % | Strategy |

|---|---|---|---|

| Conservative | $1,000 – $5,000 | 1-2% | Small allocation, diversify across crypto |

| Moderate | $5,000 – $25,000 | 3-5% | Moderate position in Bitcoin ecosystem plays |

| Aggressive | $25,000 – $100,000 | 5-10% | Large bet on Bitcoin L2 thesis |

Should You Invest in Bitlayer token?

Good for:

- Long-term crypto believers: If you’re betting on Bitcoin DeFi and can handle high risk, Bitlayer might be of interest.

- Diversified crypto investors: Consider a small allocation (maybe 1–2% of your investment portfolio), understanding you could lose your full investment.

Not good for:

- Instant-profit chasers: Almost all recent stats point to losing money if you buy to sell quickly.

- Low risk investors: Huge volatility, technical risk, and token unlock risks make Bitlayer unsuitable if you cannot handle losing money.

Final Verdict

Bitlayer could be an innovative project with long-term potential if the technology works and adoption grows, but it is extremely risky. For quick profits, odds are strongly against you—historical trends show most investors lose money in the first weeks and months after these token launches. Only invest what you can afford to lose, and don’t expect immediate gains. Carefully consider all the red flags and market data before investing.