What is Superform? A smart robot that finds the best places to earn money with your crypto automatically.

What is $UP? The token that powers Superform. Own it = own a piece, vote on decisions, earn rewards.

Sale Details: $0.08 – $0.09 per token | Dec 4-9, 2025 | ~$80M-$90M FDV | $144M TVL already live

Is it overpriced? NO – It’s FAIR and slightly CHEAP based on comparable projects

Expected returns: 2-4x realistic, 5x if everything goes perfectly

Bottom line: Good investment for 2-3% of your portfolio if you believe in crypto yield

NOTE: After token sale the Superform UP token will be listing on Bybit, MEXC, Bitget and pray for Binance.

What is Superform?

The Problem It Solves, How Superform works

Imagine you have $1,000 to invest and want to earn money from it:

Old way (time consuming):

- Find Platform A earning 4%

- Find Platform B earning 5%

- Find Platform C earning 6%

- Pick ONE and hope it’s the best

- If Platform B is better, too bad—you’re stuck with A

Superform way (smart):

- Give your $1,000 to Superform

- Superform automatically scans ALL platforms

- Finds the one paying 7%

- Puts your money there

- You earn the BEST yield without doing anything

Result: You earn $70 instead of $40 per year. That’s $30 extra for doing nothing! 💰

Learn how to join Superform Token Sale on Cookie Launchpad

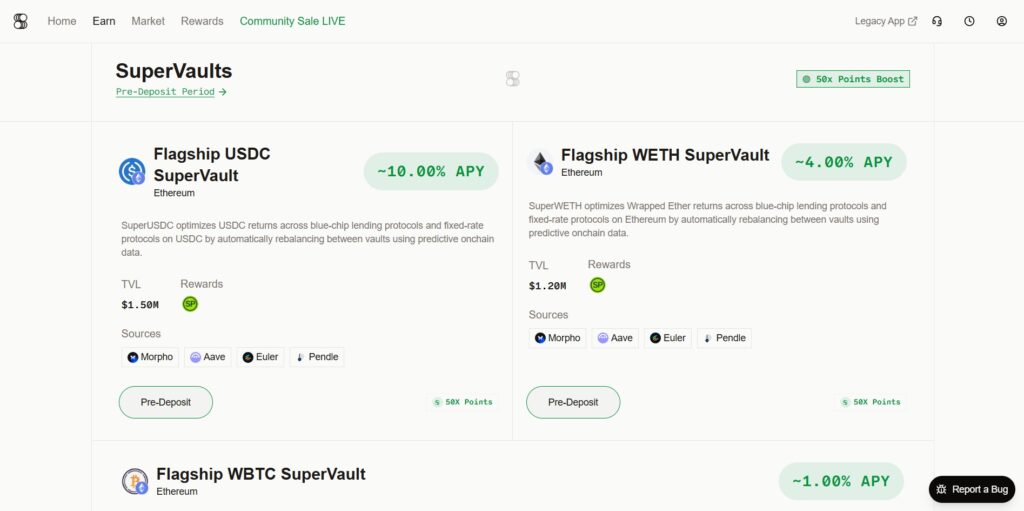

How Superform Actually Works

- You deposit USDC (stable money) into Superform

- Superform scans 100+ protocols (Aave, Compound, Morpho, etc.)

- Finds the highest yield (e.g., 6% on Morpho)

- Automatically moves your money there

- You earn 6% while sleeping

- Year later: $1,000 → $1,060

Time spent: 5 minutes

Money earned: $60

Effort required: Zero

What Does $UP Token Do? Superform Token Utility

1. Voting Power (Democracy) 🗳️

If you own $UP tokens, you vote on big decisions. For example – “Should we lower fees from 1% to 0.5%?”

More tokens = Bigger vote

2. Rewards & Incentives 💸

Hold $UP tokens → Earn rewards automatically

3. Validator & Strategist Accountability 🚔

Two types of people manage Superform:

- Validators: Check if data is correct

- Strategists: Decide where to put your money

To prevent cheating:

- They must stake their own $UP tokens

- If they cheat or mess up → Their tokens get deleted (slashing)

- It’s like a security deposit

Example: Validator claims “Aave pays 5%” but it’s actually 2% → Gets caught → Loses their $UP tokens

This keeps everyone honest! 🤝

4. Protocol Coordination 🧲

$UP is the glue that holds Superform together:

- Everyone has $UP at stake

- Everyone wants the platform to succeed (because their tokens become valuable)

- Everyone works together

- Creates trust without needing a CEO

5. Ecosystem Rewards 🎁

Get paid $UP for helping, caught a bug, marketing, etc.

Superform Token Sale Details on Cookie Legion Launchpad

| Detail | Information |

|---|---|

| Token | $UP |

| Price | $0.09 per token |

| Total Supply | 1 billion $UP |

| Tokens for Sale | 104 million $UP |

| FDV (Market Cap) | $90 million |

| Current TVL | $144 million |

| Sale Platform | Cookie Launchpad |

| Sale Dates | Dec 4-9, 2025 |

| Early Window | Dec 4-6 (discounts for whitelist) |

| Payment Method | USDC/USDT only |

| KYC Required | YES |

Check if you’re eligible before investing!

Superform Tokenomics💰

Total 1 Billion Tokens Allocated As:

| Category | % | Tokens | Timeline |

|---|---|---|---|

| Community & Ecosystem | 50.4% | 504M | Gradual unlock |

| Core Team & Advisors | 24.6% | 246M | 12-month cliff + 24 months linear |

| Strategic Partners | 22.2% | 222M | Unknown (likely 1-2 years) |

| Echo Sale (Already Sold) | 2.8% | 28M | Already distributed | 25% |

Superform Investor Backing: Tier-1 VCs 🏆

Who Invested in Superform?

| Round | Amount | Date | Lead Investors |

|---|---|---|---|

| Seed | $9.5M | Jan 2025 | Polychain Capital |

| Strategic Round | $3M | Dec 2024 | VanEck Ventures |

| Community (Echo) | $1.4M | Sept 2025 | Polymer Pals |

Top Backers

✅ Polychain Capital – Top VC that backed Arbitrum, Optimism, Aave

✅ VanEck Ventures – Traditional finance giant entering crypto

✅ Circle Ventures – Creators of USDC (trusted stablecoin)

✅ BlockTower Capital – DeFi specialists

✅ Polymer Pals – Community treasury

What this means: These are serious investors. They don’t invest in garbage projects. This is a green light! 🟢

How to Join the Sale: Step-by-Step 🎯

Phase 1: Before Dec 4 (Preparation)

- Check if you’re eligible

- Are you in USA? → Can’t participate ❌

- Are you in UK? → Can’t participate ❌

- Are you in China? → Can’t participate ❌

- Otherwise? → You’re good ✅

- Get stablecoins

- Get USDC or USDT on Ethereum, Buy it from Binance

- Amount: How much do you want to invest? ($100-1,000 recommended, but DYOR)

- Set up wallet

- Use MetaMask, Ledger, or hardware wallet

- Make sure you control the private keys

- Prepare documents

- Have ID ready (passport or driver’s license)

- Have proof of address (bank statement or utility bill)

Phase 2: KYC Registration (Dec 1-4)

- Go to Cookie Launchpad

- Click “Connect Wallet”

- Complete KYC:

- Upload ID

- Upload proof of address

- Answer questions

- Wait for approval (24-48 hours)

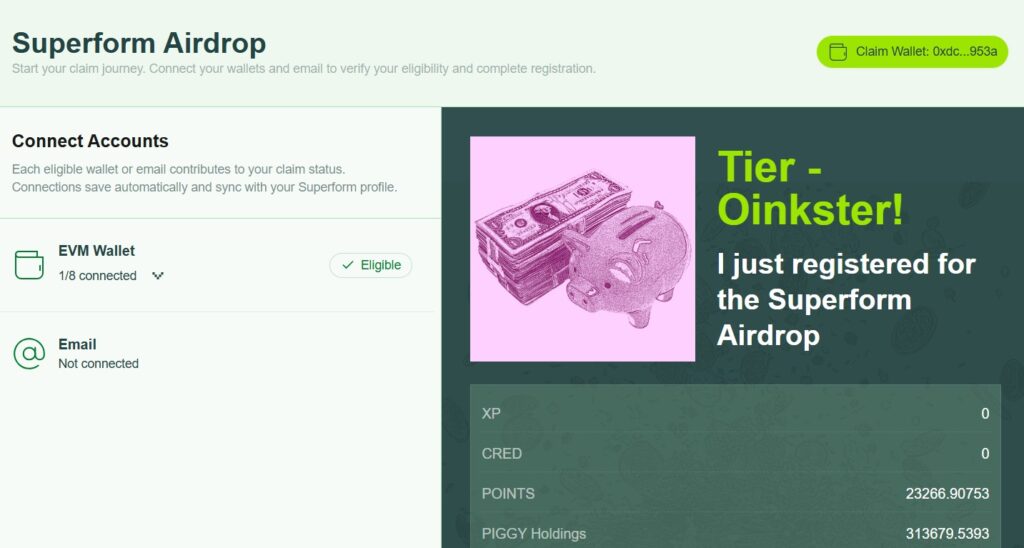

- Check if you’re whitelisted for Superform early access here – https://claim.superformfoundation.org/

Phase 3: Buy Your Allocation (Dec 4-9)

Early Window (Dec 4-6) – BETTER DEALS:

- If whitelisted, go to Cookie Launchpad

- Enter investment amount

- Confirm transaction

- Done!

Public Window (Dec 7-9) – Standard Pricing:

- Everyone else joins

- Same process

- Likely more competitive (oversubscription)

- Done!

Expected Returns: What Could You Make with Superform? 💵

Expected return: 3.9-5x over 12 months

Annualized return: ~290-390% (vs Bitcoin’s 80-100%, Ethereum’s 30-50%)

Is Superform token sale Overpriced or Underpriced? 🔍

How to Tell

Test 1: Compare to Similar Projects

| Project | FDV | TVL | Ratio |

|---|---|---|---|

| Superform | $90M | $144M | 0.62x |

| Morpho | $800M | $8B | 0.1x |

| Lido | $30B | $30B | 1x |

| Pendle | $200M | $2B | 0.1x |

Superform’s 0.62x ratio = UNDERPRICED compared to peers! ✅

Test 2: TVL Per Dollar Metric

$144M TVL ÷ $90M FDV = 1.6x“For every $1 of market cap, there’s $1.60 of real money being used”

- Higher = Better value

- Superform’s 1.6x is decent

Test 3: Price-to-Sales Ratio

$90M Market Cap ÷ $0.29M (estimated annual revenue)

= 312x P/S ratioThis is EXPENSIVE… but Superform is young, so we reduce by 50%:

Adjusted Fair FDV = $144M (fair)

Current FDV = $90M

Discount = 37% off fair value

Test 4: Launch Price Comparison

| Project | Launch Price | 1-Year Price | Gain |

|---|---|---|---|

| Lido | $0.25 | $3.50 | 14x |

| Yearn | $0.80 | $30 | 37.5x |

| Morpho | $0.15 | $3 | 20x |

| Pendle | $0.10 | $0.90 | 9x |

| Superform (est.) | $0.09 | $0.30-0.50 | 3-5x |

If Superform follows the pattern: 2-4x possible ✅

My Verdict: Fair or Overpriced?

$0.09 is FAIRLY PRICED (Slightly Undervalued)

| Valuation Range | Verdict |

|---|---|

| $0.50+ | Extremely overpriced (avoid) |

| $0.20-0.30 | Overpriced (wait for dip) |

| $0.09-0.15 | FAIR (good entry) ✅ |

| $0.03-0.08 | Underpriced (great deal) |

| $0.01-0.02 | Steal (if you can find it) |

Bottom line: $0.09 is NOT a steal, but it’s reasonable entry for a solid project 👍

Pros: Why You Should Invest in Superform ✅

1. Live Product with Real Traction

- $144M+ TVL already locked in

- Hundreds of vaults running today

- Not vaporware – it actually works

- You can use it right now, not someday

2. Top-Tier Investor Backing

- Polychain, VanEck, Circle Ventures

- These VCs back Arbitrum, Optimism, Aave

- They don’t invest in trash

- Strong signal of quality ✅

3. Community-First Tokenomics

- 50% goes to community (extremely bullish)

- Only 25% to team (low concentration)

- Echo round proves community engagement

- Everyone has incentive to help

4. Reduced Day-1 Dump Risk

- Vesting pools have 25% TGE unlock (not 100%)

- Team has 12-month cliff

- Partners have multi-year vesting

- Price should stay stable

5. Massive Market Opportunity

- Crypto yields are hot right now

- $100B+ market waiting to be captured

- Superform has first-mover advantage

- Institutional money coming into yield

6. Strong Upside Potential

- Expected 3-5x realistic

- Bullish case: 10x if adoption explodes

- Early entry before mainstream awareness

- Timing is good (before crypto boom)

Cons: Why You Should Be Careful ⚠️

1. Extreme Oversubscription Expected

2. 100% TGE Unlock Pool (Scary)

3. Fierce Competition

4. Yield Environment is Cyclical

5. Team Can Dump After 12 Months

6. No CEX Listings Confirmed Yet

7. Your Money is Locked 3+ Months

Simple Comparison: Superform vs Others 📊

How It Stacks Up

| Factor | Superform | Lido | Yearn | Morpho |

|---|---|---|---|---|

| Stage | Early 🌱 | Mature 🏢 | Mature 🏢 | Growing 📈 |

| TVL | $144M | $30B+ | $2B+ | $8B+ |

| FDV | $90M | $30B+ | $2B+ | $800M |

| Value | 0.62x | 1x | 1x | 0.1x |

| Risk | High 🔴 | Low 🟢 | Low 🟢 | Medium 🟡 |

| Upside | 10x possible | 2x maybe | 2x maybe | 5x possible |

| Entry Price | $0.09 | $3,500 | $31,000 | $3 |

| For You | Good choice ✅ | Too expensive | Too expensive | Competitor |

Verdict: Superform is best risk/reward if you believe in yield aggregation

SuperForm Token Sale FAQ 💬

Q: Is this guaranteed to make money?

A: No. You could lose -50% or -90%. Only invest money you can afford to lose.

Q: When’s the SuperForm TGE?

A: Date TBD, likely late December 2025 or early January 2026. Watch official announcements.

Q: Will it list on Binance?

A: Likely, but not confirmed. Circle Ventures, VanEck backing makes it probable.

Q: What if I miss the sale?

A: Wait for exchange listings. You can buy after TGE for potentially higher prices, but with higher risk of dump.

Q: Should I hold long-term or flip?

A: Hold 6-12 months. Short-term flipping is risky with Day 1 volatility.

Q: What if price dumps 50% after TGE?

A: This happens often. If you believe in the project, hold. If not, cut losses.

Q: How do I know if team will dump?

A: Watch their wallets post-TGE. If team consistently sells, that’s a red flag.

Key Takeaways

- Superform = Automated yield finder (get best returns without effort)

- $UP token = Governance + rewards (vote + earn passive income)

- $0.09 price = FAIR valuation (not steal, not trap)

- Expected return = 3-5x realistic (390% annualized)

- Risk = HIGH but calculated (don’t invest more than you can lose)

- Opportunity = Limited (Dec 4-9 only, likely oversubscribed)