Aztec Network is launching its highly anticipated $AZTEC token sale using a unique Continuous Clearing Auction (CCA) mechanism built with Uniswap v4. After 7 years of development and $119M raised from top VCs like a16z and Paradigm, Aztec is offering 1.547 billion tokens (15% of supply) at a starting $350M FDV—a 75% discount to their last equity valuation. Here is step by step guide to join Aztec Network token sale auction.

Key Dates:

- Registration Opens: Nov 13, 2025, 7:30 PM IST

- Early Access Bidding: Nov 13-Dec 1 (whitelist only)

- Public Auction: Dec 2-6, 2025

- Token Unlocks: 90-day lock (governance can unlock earlier)

Investment Thesis: Strong privacy L2 narrative, proven team, fair distribution model, but NO airdrop, high FDV, and controversial tokenomics have split community sentiment.

What is Aztec in Brief?

The Basics of Aztec

Aztec is a privacy-first Ethereum Layer 2 that enables developers to build applications where data, balances, transactions, and contract logic are private by default. Unlike transparent blockchains where everyone can see your activity, Aztec uses zero-knowledge proofs (ZKPs) to encrypt everything while still inheriting Ethereum’s security.

How Aztec Network Works

Aztec uses a dual execution model:

- Private functions run client-side (in your browser/device)

- Public functions run node-side (on Aztec’s decentralized network)

- ZK proofs bridge private and public computation

- Rollup batches get posted to Ethereum for final settlement

Think of it as: A privacy layer on top of Ethereum where you choose what to reveal and what to keep encrypted.

Real Use Cases of Aztec Network

- Private DeFi: Trade, lend, stake without revealing positions

- Confidential payments: Send money without exposing amounts/recipients

- Secure identity: KYC/AML compliance without doxxing personal data

- Protected NFTs: Buy/sell/own NFTs privately

- Business transactions: Enterprise payments with selective disclosure

Key Technology

- Noir: Custom programming language for writing zero-knowledge circuits

- PLONK: Advanced ZK cryptography (200x gas reduction vs Aztec 1.0)

- Hybrid model: Mix public and private functions in same contract

- Ethereum security: Inherits L1 finality and decentralization

Aztec List of Investors & Backings

Total Raised: $119 Million

| Round | Amount | Date | Lead Investors |

|---|---|---|---|

| Seed | $2.1M | 2018 | ConsenSys |

| Series A | $17M | Dec 2021 | Paradigm |

| Series B | $100M | Dec 2022 | a16z (Andreessen Horowitz) |

Tier-1 Investor List

Lead Investors:

- Andreessen Horowitz (a16z): $100M Series B leader

- Paradigm: $17M Series A leader

- ConsenSys: Early seed backer

Notable Backers:

- Coinbase Ventures

- Variant Fund

- IOSG Ventures

- HashKey Capital

- SV Angel

- Alliance DAO

- A Capital

- Libertus Capital

- Vitalik Buterin (personal investment)

What This Means

✅ Top-tier validation: a16z and Paradigm rarely miss

✅ Deep pockets: $119M runway = 5-7 years of development secured

✅ Strategic support: Coinbase Ventures = potential listing edge

✅ Vitalik backing: Ethereum founder’s endorsement is powerful

Aztec Token Sale Structure: Everything You Need to Know

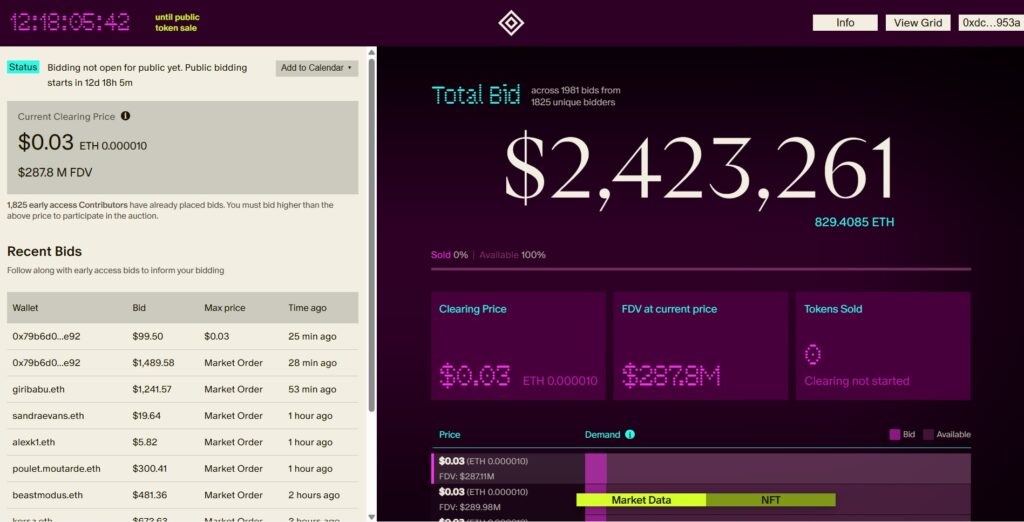

Sale Mechanics: Continuous Clearing Auction (CCA)

Aztec is using a Continuous Clearing Auction built by Uniswap Labs—a novel mechanism that’s never been used at this scale.

How It Works:

- Real-time price discovery: Price adjusts continuously based on demand

- Bid anytime: Place bids throughout the auction period

- Fair clearing: Everyone who bids above the final clearing price gets tokens at that price

- Per-user caps: Limits prevent whales from dominating (exact caps TBD)

- Transparent on-chain: All bids visible and verifiable

Example:

- You bid 10 ETH at $0.04/token (willing to pay up to that price)

- Auction ends with clearing price at $0.035/token

- You get tokens at $0.035, saving $0.005/token

- If clearing price ends above $0.04, you get nothing (bid too low)

Key Sale Parameters

| Parameter | Details |

|---|---|

| Tokens for Sale | 1,547,000,000 AZTEC (14.95% of total supply) |

| Total Supply | 10,350,000,000 AZTEC |

| Starting FDV | $350 million (floor price) |

| Token Price Range | $0.0338 (floor) to market-determined ceiling |

| Total Raise Target | ~$52.3 million (at floor price) |

| Payment Method | ETH only |

| Min Investment | No official minimum disclosed |

| Max Investment | Per-user caps (exact amount TBD) |

| Eligibility | Global (including US citizens) |

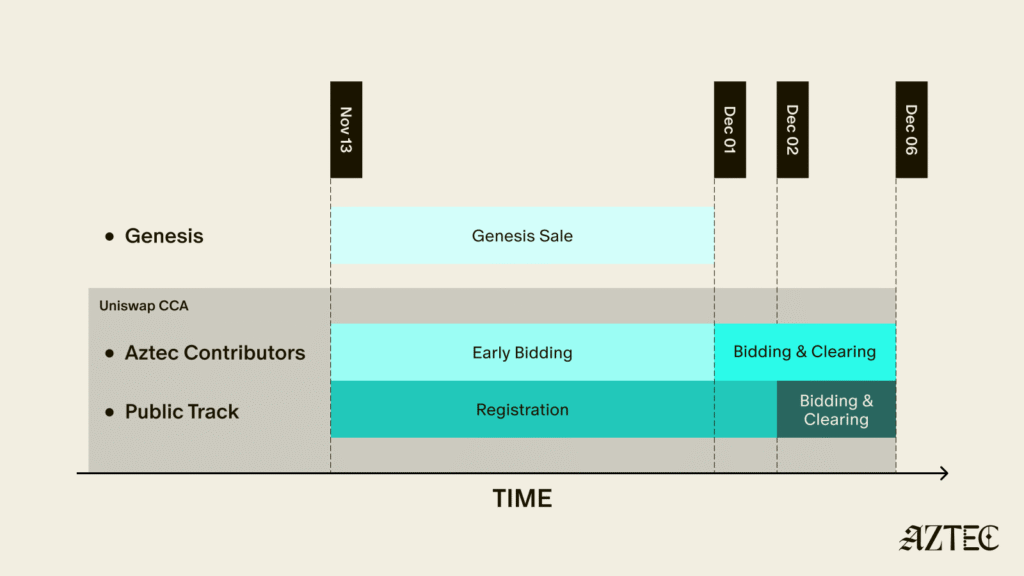

Timeline & Phases of Aztec Token Sale

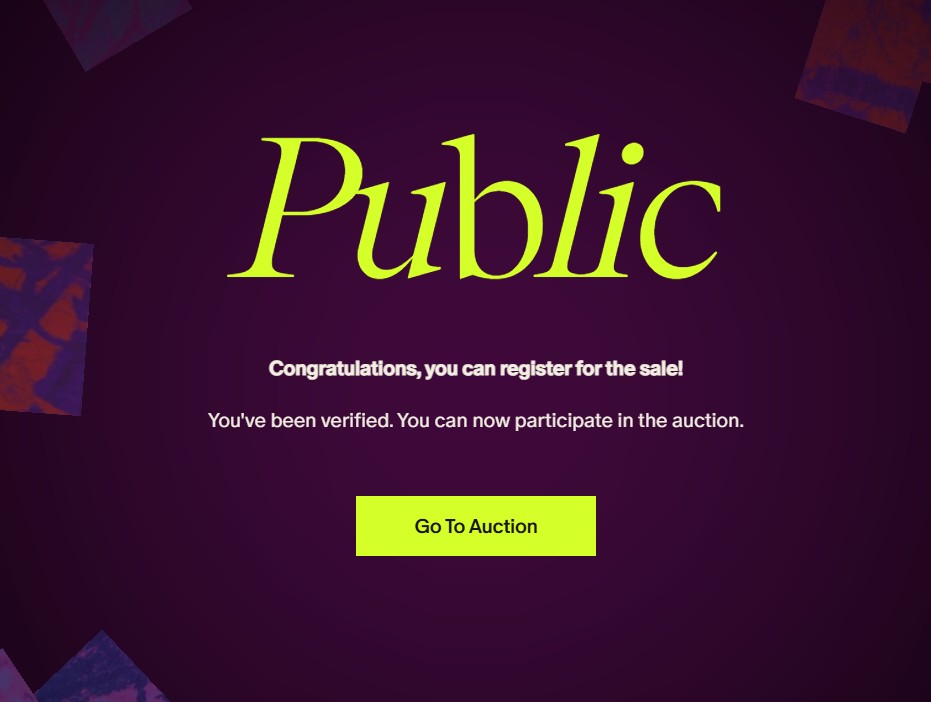

Phase 1: Registration (Nov 13 onwards)

- What: Mint soulbound NFT to confirm eligibility

- Who: All potential participants

- How: Complete zero-knowledge sanctions check via ZKPassport (Noir-powered)

- Privacy: Compliance without exposing personal data

Phase 2: Early Access Bidding (Nov 13 – Dec 1)

- Who’s eligible:

- Genesis Track: Aztec Connect users (zk.money), genesis sequencers, network operators

- Contributor Track: Testnet operators, developers, engaged community members

- Advantage: 1-day head start before public auction

- Whitelist size: 300,000+ addresses

Phase 3: Public Auction (Dec 2-6, 2025)

- Who: All NFT holders (including general public who registered)

- Duration: 5 days

- Actions: Bid, adjust bids, monitor clearing price real-time

Phase 4: Early Clearing (Dec 1)

- Who: Contributor and Genesis track successful bidders

- What: Start receiving allocated tokens (if bid clears)

Phase 5: Post-Auction (Dec 6+)

- Withdrawals: Winners can withdraw tokens and stake immediately

- Liquidity: Tokens locked for 90 days (governance can unlock earlier)

Token Allocation Breakdown

| Category | Allocation | Tokens | Notes |

|---|---|---|---|

| Token Sale | 21.96% | 2,272,500,000 | Includes this sale + future sales |

| Community Sale | 14.95% | 1,547,000,000 | Current auction |

| Ecosystem | TBD | TBD | Not disclosed |

| Team | TBD | TBD | Not disclosed |

| Investors (VC) | TBD | TBD | Not disclosed |

| Foundation | TBD | TBD | Receives 100% of sale proceeds |

⚠️ Red Flag: Full tokenomics breakdown is not published yet. Team, investor, and ecosystem allocations are unknown—this is a major transparency concern.

Lock-Up & Vesting

For Token Sale Buyers

- Initial Lock: 90 days from TGE

- Early Unlock: Aztec Governance can vote to unlock sooner

- 12-Month Cliff: If governance doesn’t vote to unlock, automatic 12-month lock applies

- After Unlock: Free to trade, stake, or hold

For Team & VCs

- Unknown: No disclosure yet (likely 2-4 year vesting with cliffs)

Uniswap v4 Liquidity Pool

- 273 million tokens to be injected post-auction

- Locked: Minimum 90 days in immutable contract

- Governance: Can unlock via vote after 90 days

Token Utility: What $AZTEC Does

1. Staking for Network Security

- Validators (“Sorters”) must stake AZTEC to generate blocks

- Non-validators can delegate to Sorters

- Rewards: Earn staking yield (APY TBD)

2. Governance

- Vote on protocol upgrades

- Decide token supply adjustments (after 12 months, governance can mint more)

- Control Uniswap pool liquidity unlock

- Manage treasury funds

3. Potential Transaction Fees

- Future use: May be required to pay fees if network enables smart contract fees

- Current: Not yet activated (testnet is free)

4. Secondary Market Liquidity

- Trade on Uniswap v4 after unlock

- Potential listings on CEXs (Binance, Coinbase, etc.)

Pros: Why You Might Invest in Aztec Auction

✅ 1. Proven Team & 7-Year Track Record

- Founded 2018: Long development = serious builders, not quick cash grab

- Been through multiple iterations (Aztec 1.0, Aztec Connect, now Aztec L2)

- Survived crypto winter 2022-2024

- Testnet live since May 2025: 70,000+ blocks, 120+ node operators

✅ 2. Tier-1 VC Backing ($119M Raised)

- a16z, Paradigm, Coinbase Ventures = best VCs in crypto

- These funds don’t invest in low-quality projects

- Deep pockets = runway for 5+ years even in bear market

✅ 3. Massive 75% Discount to Last Valuation

- Sale FDV: $350M

- Last equity FDV (implied): ~$1.4B

- Discount: 75% off = public gets better deal than VCs (rare!)

✅ 4. Fair Distribution Model (No VC Dump Risk)

- 100% of sale proceeds go to Aztec Foundation (not team pockets)

- No special VC allocation in this sale

- Per-user caps prevent whales from buying everything

- Continuous Clearing Auction = transparent, fair price discovery

✅ 5. Privacy is a Massive Narrative for 2025-2026

- Regulatory pressure on transparent blockchains (EU MiCA, US anti-money laundering)

- Institutional demand for compliant privacy (banks need confidentiality)

- Retail demand for financial privacy (no one wants their wallet tracked)

- Comp: Monero ($3B), Zcash ($700M) are old tech; Aztec is modern ZK privacy

✅ 6. Real Utility & Traction

- 8M+ TVL already on testnet

- 120+ node operators running network

- Integrations planned: Aave, Lido, Uniswap (private DeFi coming)

- Noir language: 1,000+ developers learning it (ecosystem forming)

✅ 7. No Airdrop Hunters Dumping

- Controversial decision: No airdrop = no farmers dumping Day 1

- Buyers are self-selecting believers (put money where mouth is)

- Less immediate sell pressure vs typical token launches

✅ 8. Uniswap v4 Partnership

- First major CCA launch: Proving ground for new auction tech

- Instant liquidity: 273M tokens in Uniswap pool post-launch

- Credibility: Uniswap’s endorsement adds legitimacy

Cons: Why You Should Be Cautious on Aztec Sale

❌ 1. NO Airdrop = Community Backlash

- 7 years of building, testnet users got nothing

- 300k+ testnet addresses only get early bidding (still have to pay)

- Viral criticism: “Worst tokenomics,” “VCs get everything,” “OGs ignored”

- Risk: Angry community = weak post-launch support, selling pressure

❌ 2. Incomplete Tokenomics Disclosure

- Unknown: Team allocation, VC vesting, ecosystem distribution

- Red flag: Why hide this critical info?

- Risk: If team/VCs unlock early, massive supply dump incoming

- Trust issue: Projects with hidden tokenomics often underperform

❌ 3. High Starting FDV ($350M)

- $350M for a testnet with 8M TVL is steep

- Comp: StarkNet launched at ~$8B FDV (already established); zkSync at ~$6B

- Aztec: No mainnet yet, limited dApps, unproven PMF (product-market fit)

- Risk: Limited upside if valuation already inflated

❌ 4. Unproven CCA Auction Mechanism

- Never tested at scale: What if it fails mid-auction?

- Gas wars: High Ethereum gas fees during bidding = expensive entry

- Complexity: Retail may not understand how to bid effectively

- Risk: Technical glitches, unfair advantages for sophisticated bidders

❌ 5. Aztec Connect Shutdown (2023) Damaged Trust

- 2022: Launched Aztec Connect (private DeFi bridge)

- 2023: Shut it down abruptly, pivoted to full L2

- Community reaction: “They abandoned us”

- Concern: What if Aztec L2 also pivots/shuts down?

❌ 6. Privacy L2 Competition is Brutal

- Competitors: Mina, Aleo, Manta Network, Penumbra, Iron Fish

- Challenge: All building privacy with ZK proofs

- Differentiation: Unclear if Aztec’s hybrid model is enough to win

- Risk: Becomes commoditized, loses market share

❌ 7. Regulatory Risk for Privacy Coins

- US: SEC/Treasury cracking down on privacy tech (Tornado Cash sanctions)

- EU: MiCA regulations may restrict privacy tokens

- Exchange delistings: Coinbase, Binance have delisted privacy coins before

- Risk: AZTEC gets labeled “privacy coin” → banned/delisted → price tanks

❌ 8. 90-Day Lock with Governance Uncertainty

- You can’t sell for 90 days minimum

- Governance vote required to unlock early (uncertain outcome)

- Risk: Price pumps in first week, you’re locked out; price dumps, you’re trapped

- Opportunity cost: Capital locked while market moves

❌ 9. No CEX Listings Confirmed

- Speculation only: Coinbase Ventures backing ≠ guaranteed Coinbase listing

- Risk: If only DEX liquidity (Uniswap), low volume = high slippage

- Comp: Many well-funded projects still struggle to get Tier-1 listings

❌ 10. Testnet ≠ Mainnet Success

- Testnet metrics look good (70k blocks, 120 operators)

- But: Testnet users don’t risk real money, no stress tests yet

- Mainnet launch risk: Bugs, exploits, scalability issues

- Aztec Connect precedent: Previous product had issues → shutdown

Investment Decision Matrix

| Factor | Rating (1-10) | Notes |

|---|---|---|

| Team & Execution | 8/10 | Proven builders, 7-year track record |

| Backing & Investors | 9/10 | a16z, Paradigm = tier-1 validation |

| Technology | 8/10 | Innovative ZK privacy, but unproven at scale |

| Valuation | 5/10 | $350M FDV for testnet is high |

| Tokenomics | 4/10 | Incomplete disclosure = major red flag |

| Community Sentiment | 4/10 | Split 50/50 (no airdrop backlash) |

| Timing & Narrative | 7/10 | Privacy L2 is hot, but competition fierce |

| Distribution Model | 7/10 | Fair CCA, but unproven mechanism |

| Liquidity & Listing | 6/10 | Uniswap confirmed, CEX listings uncertain |

| Risk/Reward | 6/10 | Moderate upside, high downside risk |

Overall Score: 6.4/10 — Moderate investment for risk-tolerant investors with privacy thesis conviction.

Expected Returns & Price Scenarios

Conservative Scenario (40% probability)

Assumptions: Mainnet launches smoothly, moderate adoption, privacy narrative cools off

- TGE Price: $0.04-0.05 (15-50% above floor)

- 6-Month: $0.06-0.08 (2-2.3x)

- 12-Month: $0.10-0.15 (3-4.5x)

- Market Cap at 12mo: $1B-1.5B FDV

- Annualized Return: ~150-250%

Bullish Scenario (35% probability)

Assumptions: Privacy becomes must-have, major DeFi integrations, Tier-1 CEX listings

- TGE Price: $0.08-0.12 (2.5-3.5x)

- 6-Month: $0.15-0.25 (4.5-7.5x)

- 12-Month: $0.30-0.50 (9-15x)

- Market Cap at 12mo: $3B-5B FDV (rivaling StarkNet)

- Annualized Return: ~500-1000%

Bear Scenario (25% probability)

Assumptions: Mainnet bugs, regulatory crackdown, no CEX listings, community exodus

- TGE Price: $0.025-0.035 (0.75-1x floor price)

- 6-Month: $0.015-0.025 (0.5-0.75x)

- 12-Month: $0.01-0.02 (0.3-0.6x)

- Market Cap at 12mo: $100M-200M FDV (zombified)

- Annualized Return: -40% to -70% loss

How to Participate: Step-by-Step

Phase 1: Preparation (Before Dec 2)

- Mint NFT: To become eligible for the Public token sale bidding

- Get ETH: You’ll need ETH to bid (amount depends on your investment size)

- Gas buffer: Add 10-15% extra ETH for transaction fees

- Set up wallet: MetaMask, Rainbow, or hardware wallet (Ledger/Trezor)

- Bookmark official site: aztec.network (verify URL!)

Phase 2: Registration (Nov 13 – Dec 1)

- Visit aztec.network or official sale link

- Connect your wallet

- Complete sanctions check: ZKPassport powered by Noir circuits

- Privacy-preserving: Your data isn’t exposed

- Mint soulbound NFT: Confirms your eligibility

- Cost: Small gas fee (0.001-0.01 ETH)

- Check eligibility: See if you qualify for early access (Genesis/Contributor track)

Phase 3: Bidding (Dec 2-6 for public)

- Return to auction site on Dec 2, 2025

- Monitor clearing price: Updates in real-time

- Place bid:

- Enter ETH amount you want to spend, get it from one of the crypto exchanges

- Set maximum price per token you’re willing to pay

- Example: “I’ll spend 10 ETH, max price $0.05/token”

- Adjust bid: Can change your bid anytime during auction

- Track position: See if your bid is above/below current clearing price

Phase 4: Post-Auction (Dec 6+)

- Check results: Did your bid clear?

- Claim tokens: Withdraw AZTEC to your wallet

- Optional: Stake immediately: Earn staking rewards (Sorter delegation)

- Monitor unlock: Track 90-day lock period and governance votes

Final Verdict: Should You Invest?

✅ Pros to investing in Aztec Network Auction:

- Believe in privacy as a must-have for crypto’s future

- Trust a16z + Paradigm’s due diligence

- Can afford to lock capital for 90+ days

- Are comfortable with 6-10x upside, 40-70% downside risk profile

- Want exposure to Ethereum L2 privacy sector

- Are risk-tolerant and can handle volatility

Suggested Allocation: 2-5% of crypto portfolio

❌ Why Skip Aztec Token Sale:

- Need guaranteed short-term returns

- Are uncomfortable with incomplete tokenomics

- Believe privacy coins will face regulatory bans

- Think $350M FDV is too high for a testnet

- Are still angry about no airdrop (community backlash concerns you)

- Prefer proven mainnet projects over experimental tech

Alternative: Wait for mainnet launch, buy the dip at lower valuations

Risk Summary: Know What You’re Getting Into

Critical Risks

- 🚨 Incomplete tokenomics (team/VC allocation unknown)

- 🚨 Regulatory crackdown on privacy tech

- 🚨 No airdrop = angry community → sell pressure

Moderate Risks

- ⚠️ High $350M FDV for testnet

- ⚠️ Unproven CCA auction mechanism

- ⚠️ 90-day lock with uncertain governance unlock

- ⚠️ Competition from Mina, Aleo, Manta, etc.

Manageable Risks

- ⚠️ Technical bugs on mainnet launch

- ⚠️ No CEX listings confirmed yet

- ⚠️ Aztec Connect shutdown precedent

Comparison: AZTEC vs Other Token Sales

| Project | FDV | Unlock | Airdrop | Backers | Risk/Reward |

|---|---|---|---|---|---|

| AZTEC | $350M | 90-day lock | ❌ No | a16z, Paradigm | 6/10 |

| Immunefi | $133M | 100% TGE | ❌ No | Framework, Electric | 5/10 |

| Tria | $100-200M | 2-mo cliff | ✅ Yes | Polygon, Aptos | 7/10 |

| BOB | $165-230M | 20% TGE | ✅ Yes | Top VCs | 6/10 |

AZTEC ranks: Middle of the pack—better than Immunefi, slightly worse than Tria.

Conclusion

AZTEC is a high-risk, high-reward bet on privacy becoming crypto’s next killer feature. The team is proven, backers are elite, and technology is cutting-edge. But incomplete tokenomics, no airdrop backlash, and high FDV create significant headwinds.

For risk-tolerant investors with 2-5% portfolio allocation to speculate on privacy L2s, AZTEC is worth considering. For conservative investors or those needing liquidity, wait for mainnet and better transparency.

Expected 12-month return: 3-5x (base case), with 10-15x upside if everything clicks and -50-70% downside if regulatory/community issues spiral.

Quick Action Checklist to Participate in Aztec Token Sale

- Bookmark aztec.network (verify URL!)

- Prepare ETH + gas buffer. You can buy on Binance with any Bank Account.

- Set up wallet (MetaMask, Rainbow, or hardware)

- Register & mint NFT before Dec 2

- Check whitelist eligibility (Genesis/Contributor track)

- Monitor auction clearing price Dec 2-6

- Set max bid price you’re comfortable with

- Plan post-auction: stake or hold?

- Track 90-day lock period & governance votes

- Set alerts for CEX listing announcements

Disclaimer: This is educational content, not financial advice. Crypto investments are extremely risky. Only invest what you can afford to lose. Always DYOR (do your own research) and consult a financial advisor before investing