DeFi means and its full form is Decentralized Finance. You have seen that whole twitter, telegram and social media are buzzing about that. Terms like yield farming, yearns, sushi, pool, staking, etc. Every coin that says DeFi got spiked up and pumped like hell. So, what is Defi and why it is the big thing now? How to buy DeFi coins before anyone else or before they can get listed over main exchanges and pump?

What is DeFi? Why DeFi is pumping hard now?

DeFi is an abbreviation for “Decentralized Finance”, which aims to remove middlemen from trading cryptocurrencies from exchanges like Binance. These are open-source networks that can provide lending, borrowing, buying and selling securities, portfolio management, cryptocurrency wallets. These smart contracts can be created on any network, but the majority of them now are created on Ethereum.

To figure out if a coin is DeFi coin, you have to check whether its core of functionality has a stablecoin like USDT, PAX, Dai. You can know about top DeFi coins from Coinmarketcap here or here on DeFiPulse.

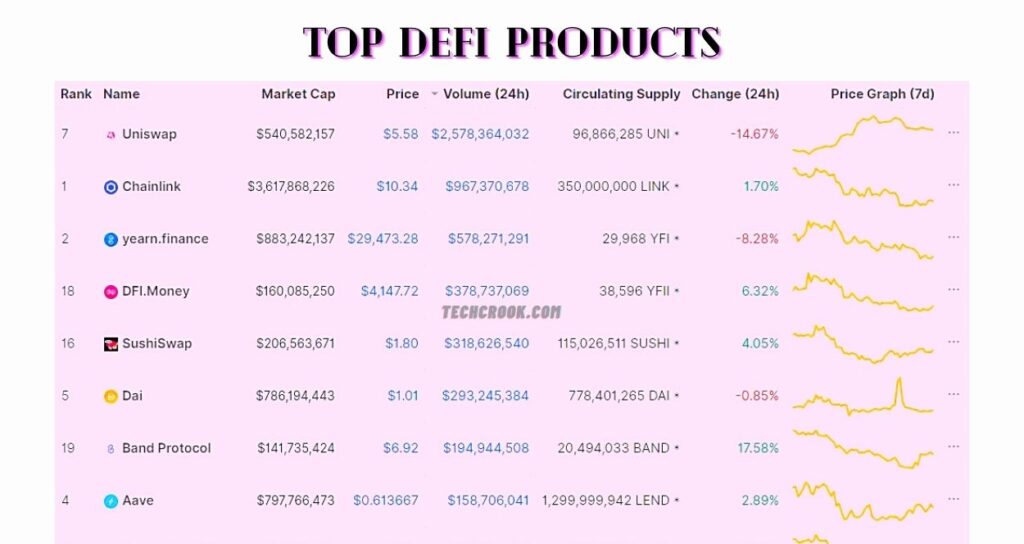

DeFi includes Borrowing and Lending, Decentralized exchange, Asset Management protocols, Prediction markets, Insurances, Synthetic asset management. Here is an interesting list of DeFi tokens by DeFiPulse that breaking all the barriers and showing supremacy in DeFi market.

What is borrowing and lending in cryptocurrency DeFi?

DeFi lets you use Borrow and Lend without any bank account or application review. In a general case scenario, a borrower looks for a lender to give him a loan. But with DeFi, we can say it’s slightly different as lenders will look for borrowers in some applications. As the interest rate is being calculated as per current demand and supply instead of fixed interest.

DeFi borrowers stake their cryptocurrencies as security, which is locked with a smart contract until the loan is paid. Examples for this kind of DeFi lending platform are Compound(COMP), Aave(LEND), Maker(MKR), etc. You can also buy these cryptos from global cryptocurrency exchanges like Binance, Kucoin, Huobi Global, and others.

What is Yield Farming?

Yield farming is so useful in terms of DeFi and beloved functionality that everyone uses. First being used by Compound, where users get tokens by participating in the token economy for providing liquidity. One step forward to that of the Uniswap app does at that point in time. Because of Yield farming, providing liquidity was now rewarding, which became quite successful and everyone just started copying it.

What is DeFi decentralized exchanges in cryptocurrency?

Normal trading includes 3rd party providers like Binance, KuCoin, Hotbit, Huobi, Coinbase which takes fees for trading. DeFi exchanges remove these 3rd party exchanges with smart contracts and act as a keeper of funds. Some of them are Uniswap, Bancor, Curve, Synthetix. There are no teams behind the project instead there only some pieces of code.

What is DeFi asset management protocol in cryptocurrency?

DeFi asset management tools are similar to normal asset management companies in the crypto world. In DeFi, it is also automated by smart contracts similar to automated funds, asset aggregators. We have seen how an asset management protocol Parsiq(PRQ) gets 400% to its ICO.

For example, yearns.finance, Melon, Insta.dapp, Cream. You can buy these cryptocurrencies from Huobi Global and Binance.

What is DeFi prediction markets and insurances in cryptocurrency?

Prediction markets in DeFi are similar to normal prediction markets. You can bet on the expected future price of a cryptocurrency and earn by going long or short with a coin from exchanges like Kucoin Futures and Binance Futures. on-chain options, and insurances, in a fully automated smart contract. These platforms will also be used to insure against accidents and natural disasters, later in the future.

For example, Augur, Nexus Mutual, and Opyn. You can buy these cryptocurrencies from Hotbit and Binance.

What is DeFi synthetic asset management in cryptocurrency?

Synthetic asset management is what is flaming out of all. Synthetic assets are a mix of assets that resembles the returns of another asset. Combination of assets that create the same financial change as the other asset would. Such as options, futures, or swaps, which resembles an underlying asset. Examples of such underlying assets include bonds, commodities, stocks, interest rates.

These platforms are so popular right now that Bitcoin is currently being tokenized faster than it is being mined. Current platforms acting as synthetic bridges include BitGo, REN, and KEEP Network. You can buy KEEP from Hotbit.

Where to buy DeFi coins?

DeFi coins are becoming popular day by day. We can see looking in the fact that about 10 coins are coming out per week in September 2020. These coins are available at every other exchange. Now, exchanges are FOMOing to list new DEFI coins. Believe me, Uniswap(UNI) coin gets listed one at all major exchanges at once.

You can buy 70+ DeFi coins from Hotbit itself, while we have Binance, Kucoin, Huobi Global to get the best of DeFi projects to trade with.

8 thoughts on “What is DeFi? Types of DeFi How to invest in DeFi cryptocurrencies”

Comments are closed.